Como Stephen Gould aumentou sua capacidade em 30% sem fazer uma única contratação

Desbloqueie todo o potencial de seus investimentos com a solução de análise de private equity da Slingshot. Obtenha insights em tempo real sobre as empresas do portfólio, acompanhe as principais métricas e concentre-se no crescimento e na maximização do ROI diretamente do seu software de gerenciamento de trabalho. Aproveite a análise de dados de private equity com tecnologia de IA para tomar decisões mais inteligentes e rápidas.

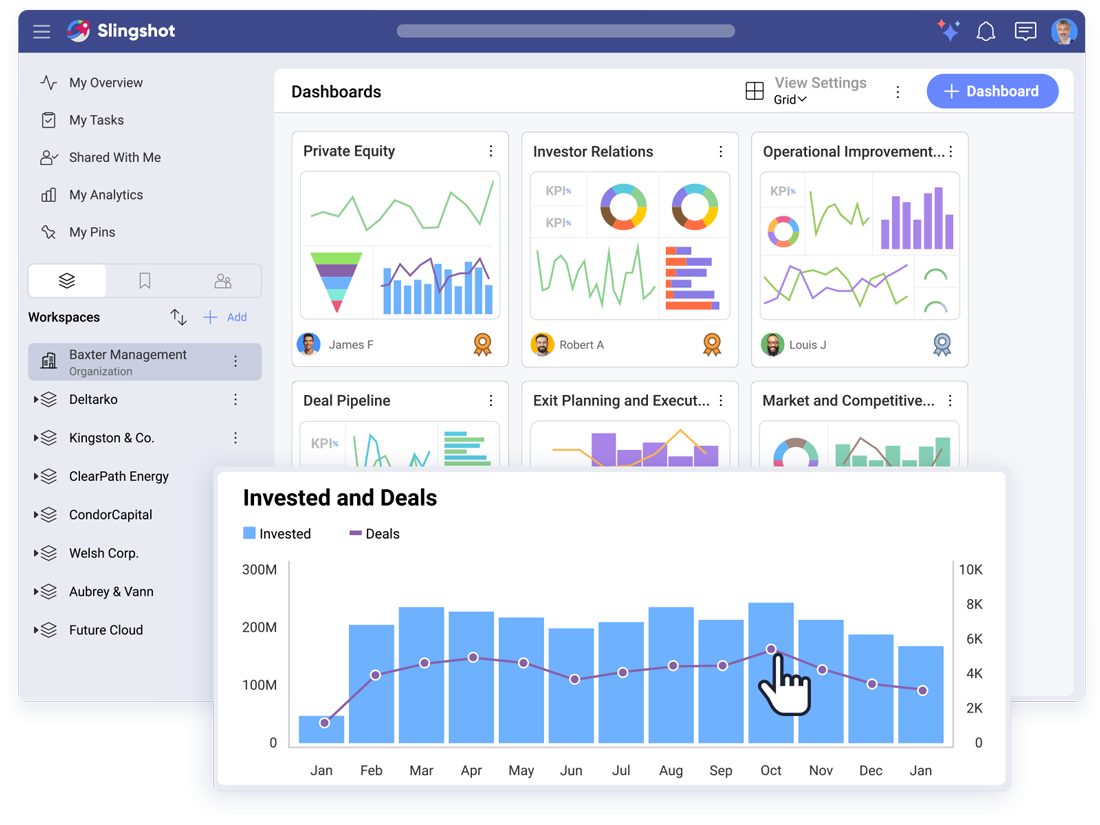

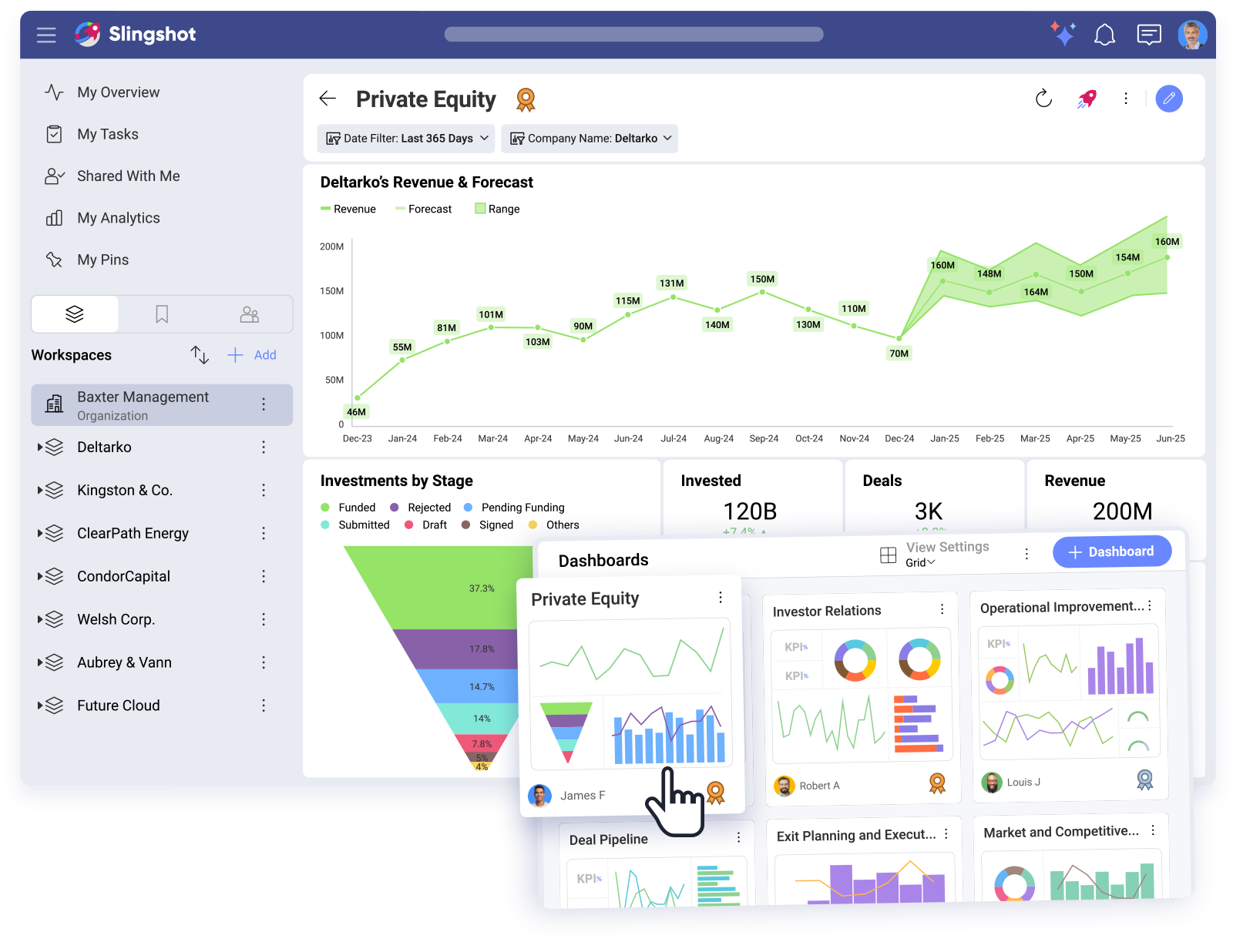

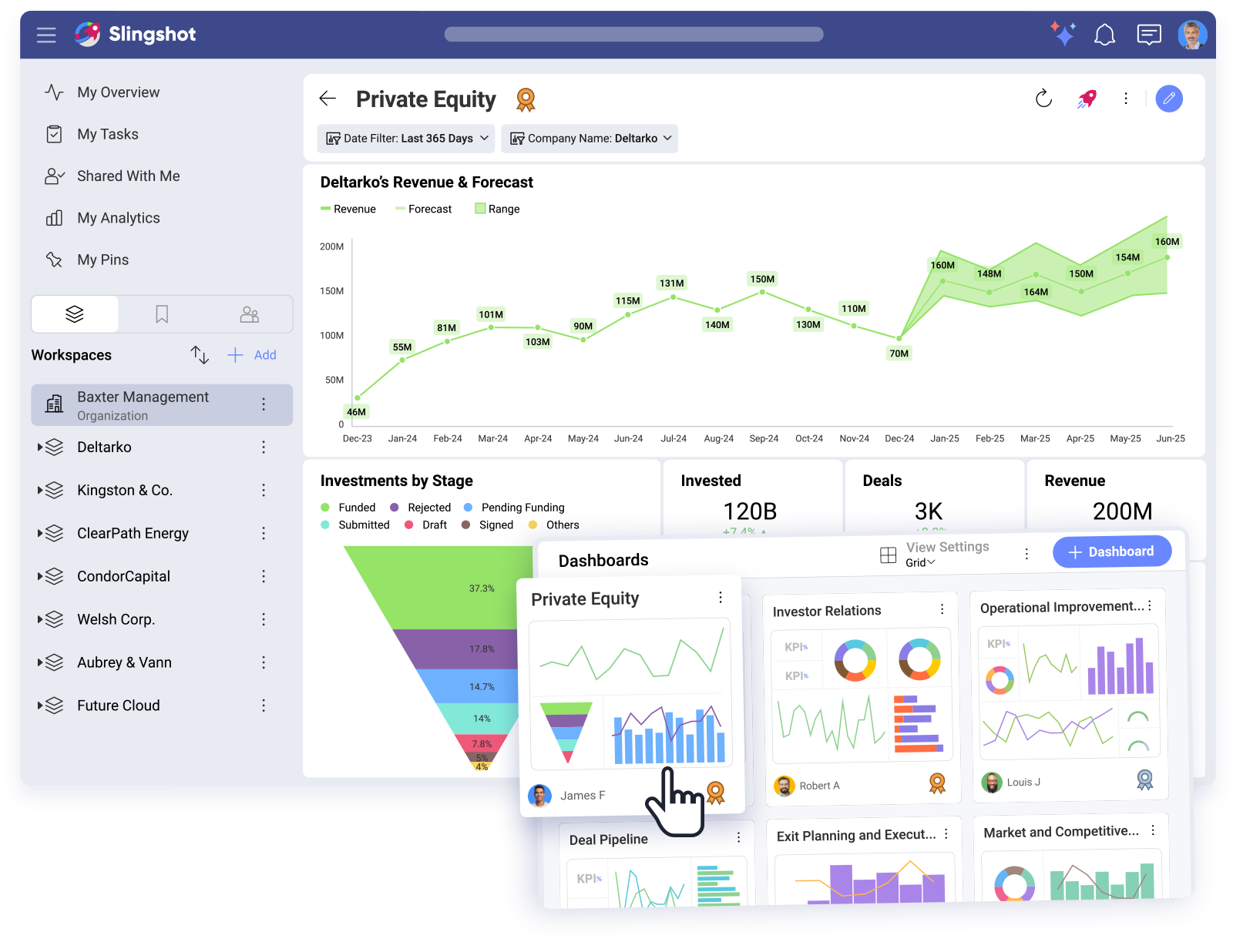

A solução de análise de private equity da Slingshot centraliza todos os dados do portfólio, oferecendo aos investidores, operadores e membros do conselho uma visão única e em tempo real do desempenho da empresa. Em vez de relatórios dispersos e planilhas difíceis de ler, o Slingshot fornece um painel abrangente com insights baseados em IA, métricas-chave e rastreamento de avaliação. Do desempenho financeiro à eficiência operacional, tudo está acessível em uma plataforma unificada. Com uma visão geral clara e orientada por dados, as equipes de private equity podem identificar riscos, descobrir oportunidades e tomar decisões de investimento mais inteligentes, economizando tempo e melhorando a execução.

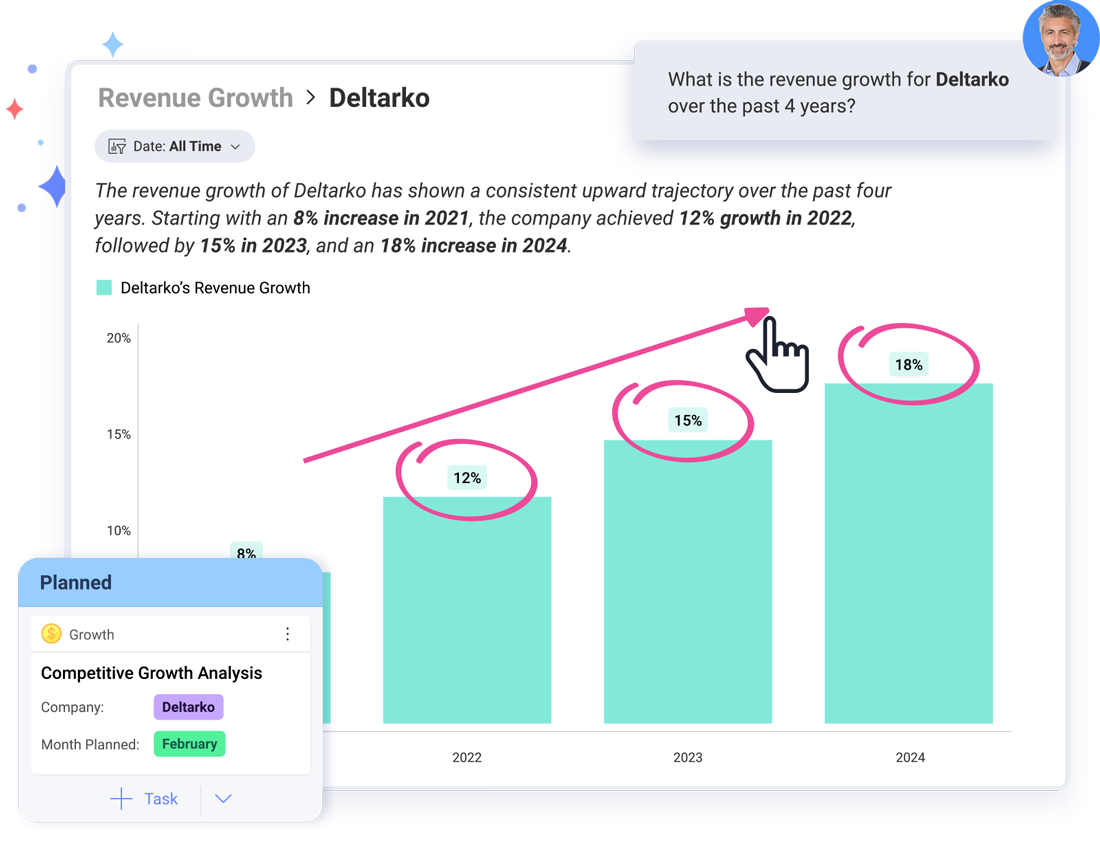

Simplifique a análise de portfólio de private equity unificando dados financeiros, operacionais e de mercado em uma única fonte de verdade. Investidores, operadores e membros do conselho obtêm acesso instantâneo a KPIs em tempo real, eliminando relatórios fragmentados e coleta manual de dados. Com rastreamento padronizado em todas as empresas do portfólio, os tomadores de decisão podem comparar o desempenho, identificar tendências e se concentrar no crescimento da avaliação. Ao fornecer insights precisos baseados em IA, Slingshot garante que as empresas de private equity possam impulsionar a execução baseada em dados e maximizar o ROI com confiança.

Substitua relatórios manuais lentos por análises de dados de private equity em tempo real com inteligência artificial. Slingshot solução de análise de private equity oferece clareza instantânea sobre a integridade do portfólio, risco e oportunidades de crescimento, automatizando a agregação de dados, rastreamento de KPI e análise de desempenho. Com todas as principais métricas alojadas sob o mesmo teto, as equipes de private equity podem identificar tendências, tomar decisões informadas e executar estratégias rapidamente. Não há mais oportunidades perdidas devido à lentidão dos relatórios. É hora de maximizar sua avaliação e ROI.

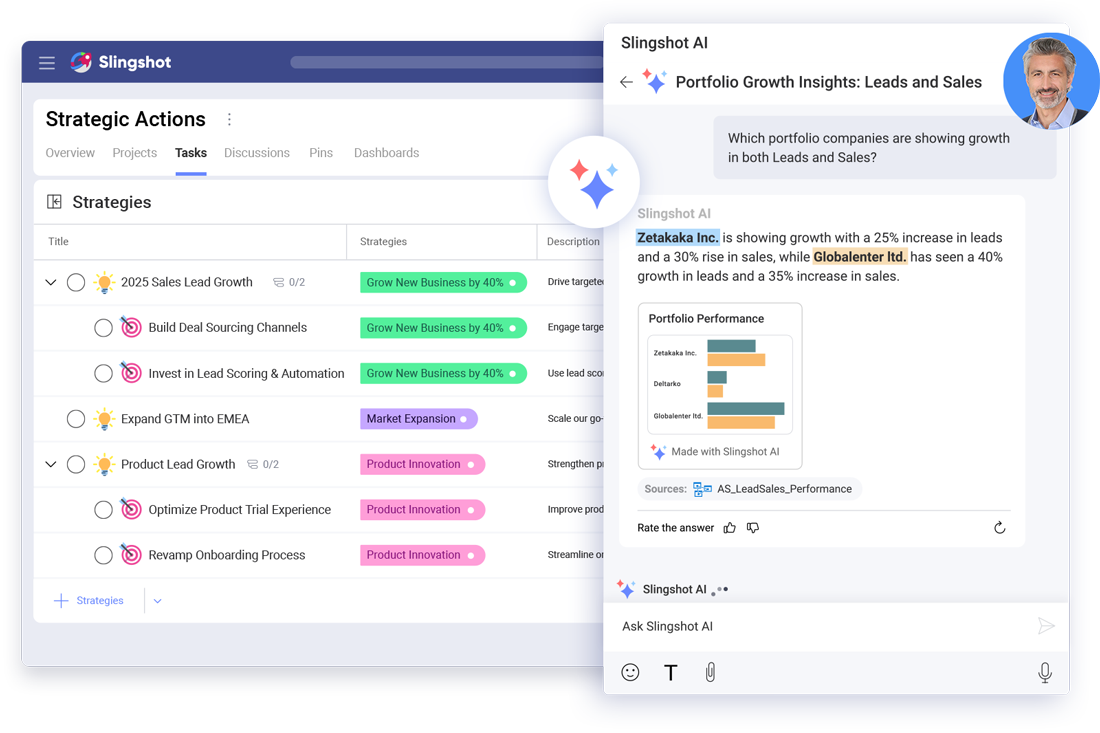

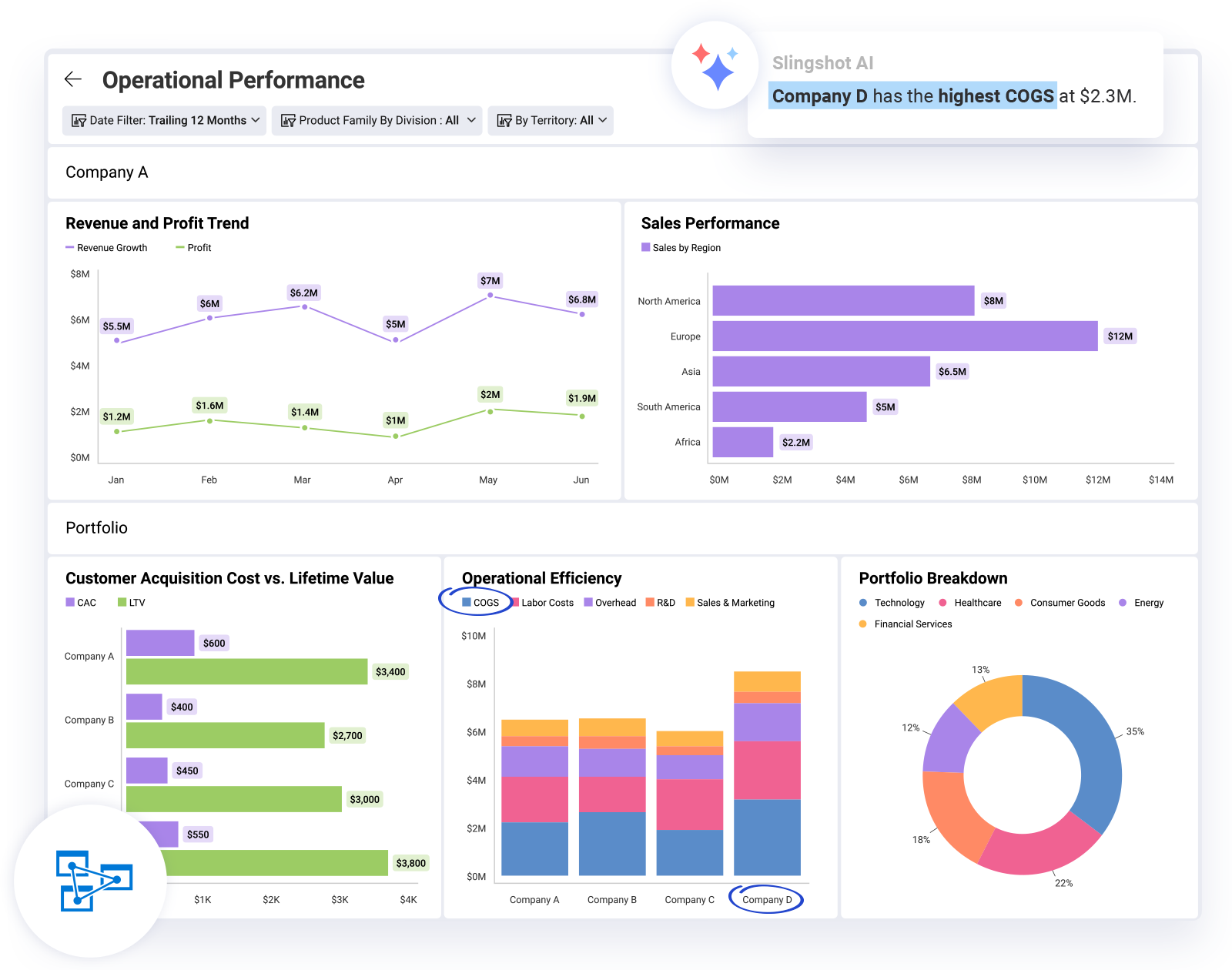

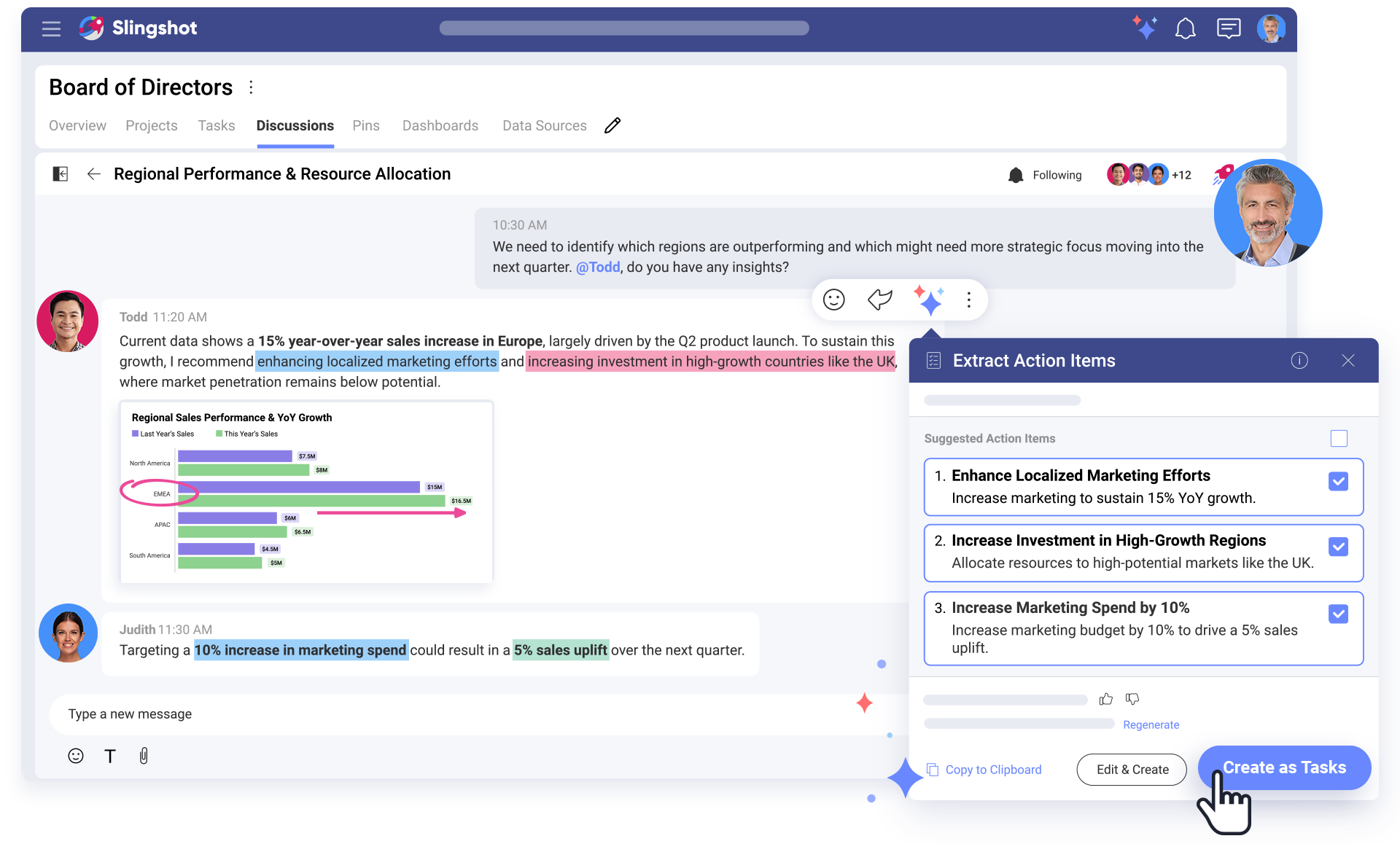

Slingshot vai além da análise de dados de private equity, fornecendo ferramentas de execução baseadas em IA que transformam insights em ação. Investidores e operadores podem alinhar a estratégia com a execução, garantindo que as empresas do portfólio se concentrem em iniciativas de crescimento de alto impacto. Com colaboração em tempo real, automação de fluxo de trabalho e tomada de decisão baseada em dados, a Slingshot ajuda as equipes a simplificar as operações, otimizar recursos e acelerar o crescimento da avaliação. Ao manter todos focados em resultados mensuráveis, as empresas de private equity podem gerar sucesso repetível em todo o seu portfólio.

Desbloqueie todo o potencial de seus investimentos com a solução de análise de private equity da Slingshot. Nossa plataforma de gerenciamento de trabalho baseada em IA cria uma fonte de verdade, facilitando a localização de oportunidades de crescimento, o rastreamento de métricas-chave e o aprimoramento dos processos de gerenciamento e avaliação pré e pós-risco por meio de análises de portfólio de private equity com tecnologia de IA.

Desbloqueie todo o potencial de seus investimentos com a solução de análise de private equity da Slingshot. Nossa plataforma de gerenciamento de trabalho baseada em IA cria uma fonte de verdade, facilitando a localização de oportunidades de crescimento, o rastreamento das principais métricas e o aprimoramento dos processos de avaliação e gerenciamento pré e pós-risco por meio de análises de portfólio de private equity com inteligência artificial.

Slingshot é muito mais do que um software de BI de private equity. É uma plataforma de gerenciamento de trabalho tudo-em-um aprimorada com ferramentas de análise de private equity. Esses recursos o tornam um assistente irreplicável para equipes operacionais que tentam conectar estratégias a resultados mensuráveis com insights de desempenho em tempo real.

Ao unificar dados de vendas, marketing e finanças, Slingshot garante que as equipes permaneçam alinhadas com as prioridades estratégicas enquanto tomam decisões baseadas em dados que impulsionam o crescimento da avaliação. Com nossa análise de private equity baseada em IA, as equipes podem identificar tendências, otimizar recursos e refinar a execução de entrada no mercado, garantindo o sucesso do portfólio a longo prazo.

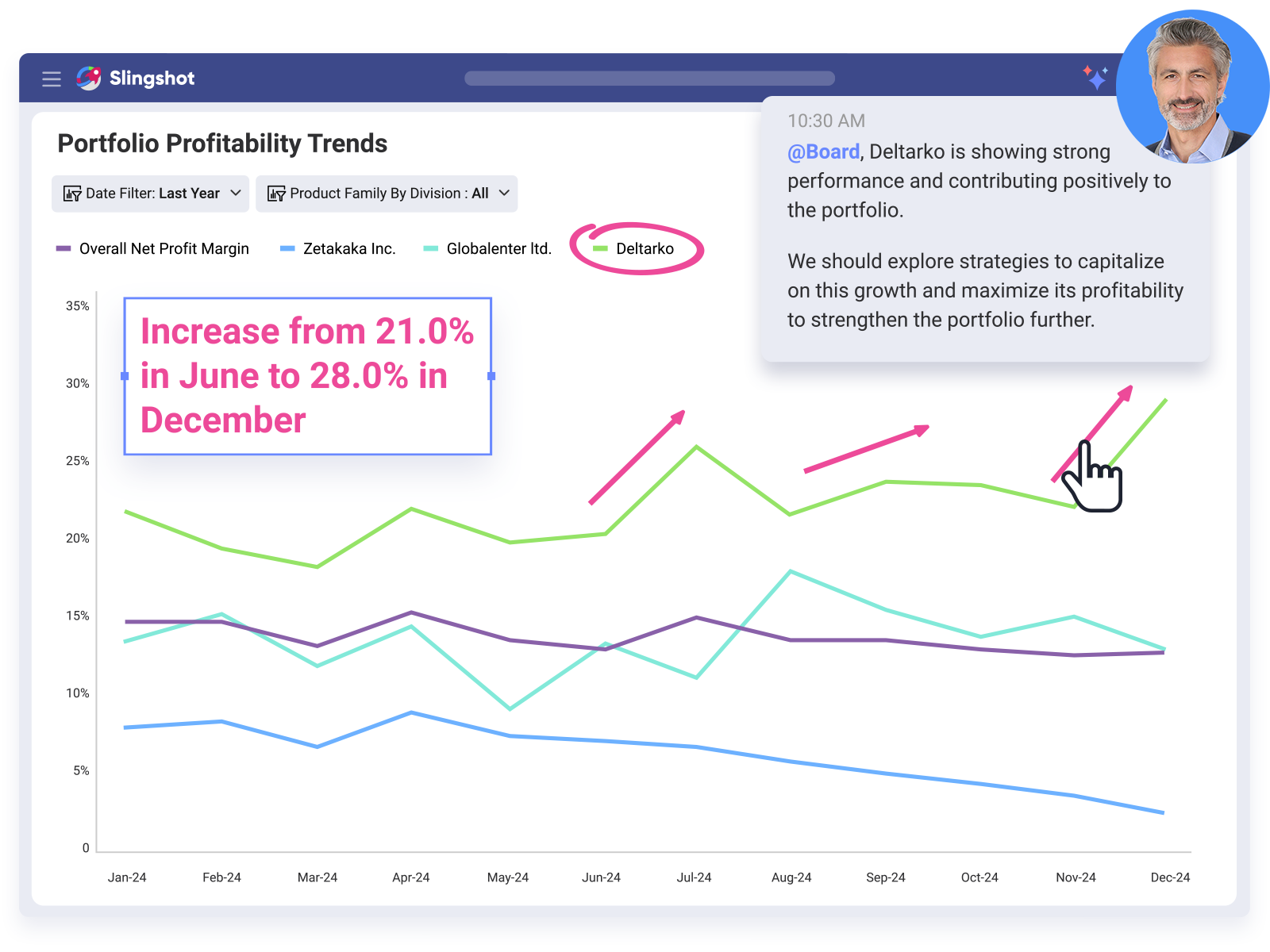

Slingshot fornece análises de private equity que ajudam os membros do conselho a conectar a estratégia com a execução e otimizar a alocação de recursos. Ao consolidar a análise de dados em private equity em uma única plataforma, Slingshot garante visibilidade clara e em tempo real do desempenho do portfólio, impulsionadores de avaliação e indicadores-chave de crescimento. Os membros do conselho e executivos podem colaborar perfeitamente, acessar relatórios padronizados e acompanhar a saúde dos negócios com insights orientados por dados, garantindo o alinhamento entre todas as partes interessadas.

A plataforma de gerenciamento de trabalho com tecnologia de IA da Slingshot garante que sua estratégia esteja alinhada com sua execução diária. Oferecemos a você um lugar para criar colaboração em tempo real, gerenciar tarefas, supervisionar equipes e visualizar métricas-chave para que todos saibam as prioridades certas. Use ferramentas práticas que ajudam você a trabalhar de forma mais inteligente e melhorar as margens.

Analise seus dados de vários ângulos aplicando filtros, permitindo que você se concentre em aspectos específicos e descubra insights valiosos.

Exporte seus painéis e visualizações para Excel ou formatos prontos para apresentação, como PDF e PPT, com apenas alguns cliques.

Aprofunde-se em seus dados com o recurso de detalhamento, permitindo que você explore detalhes granulares e identifique tendências ou anomalias.

Aproveite o poder do aprendizado de máquina para prever tendências futuras, detectar padrões e obter insights preditivos.

conecte visualizações em um painel a outros painéis ou URLs, facilitando uma análise abrangente e permitindo uma navegação sem esforço entre insights de alto nível e exibições detalhadas.

Combine dados de várias fontes, permitindo que você crie uma visão holística e descubra correlações ocultas.

Gere cálculos personalizados a partir de seus dados, criando campos adicionais para suas visualizações que levam a insights mais profundos.

Nunca perca nada e aumente a colaboração com o bate-papo no contexto no nível da tarefa.

Nossa equipe cuida de todo o processo de configuração, da integração de dados ao treinamento de IA. Seus dados permanecem na sua nuvem, garantindo propriedade total enquanto aproveita a conformidade SOC2 e GDPR da Slingshot.

A má coleta de dados pode ser prejudicial ao seu processo de due diligence de private equity. Dados imprecisos, fragmentados e dispersos levarão a desvantagens financeiras significativas, avaliações desalinhadas, ineficiências operacionais e outros efeitos devastadores em sua empresa de private equity.

Colocar dinheiro em sua empresa de private equity não pode mais impulsionar o crescimento que os membros do conselho esperam. Para escalar sua empresa de PE em 10x, você precisa de dados. No entanto, não são quaisquer dados que serão suficientes; Você precisa de análises de dados bem estruturadas, organizadas e claras incorporadas à sua plataforma de gerenciamento de trabalho para que todas as partes interessadas possam lê-la, entendê-la e utilizá-la.

Os CEOs precisam de acesso fácil e rápido aos seus KPIs – eles precisam de um painel de KPI do CEO que lhes permita monitorar o desempenho de seus negócios em um determinado período de tempo.

A solução de análise de private equity da Slingshot garante uma integração perfeita enquanto você se concentra no crescimento de seus negócios. Nossa equipe de serviços de dados fará o trabalho pesado para você:

Oferecemos treinamento especializado em estratégias de crescimento Slingshot e baseadas em dados, ajudando você a aproveitar a experimentação e os principais insights que impulsionam a avaliação e otimizam a execução. Com o Slingshot, você obtém uma ferramenta de análise escalável e baseada em IA que alinha as empresas do seu portfólio com as prioridades estratégicas.

Agende uma consulta com nossa equipe para ver como Slingshot pode impulsionar o crescimento em seu portfólio. Vamos explorar como podemos adaptar nossas soluções para impulsionar sua história de sucesso.